From Paycheck to Wealth

- hej0305

- Aug 21, 2024

- 10 min read

Updated: Aug 23, 2024

Get Rich on Autopilot

Anyone with a steady income can build a fortune. The secret? Consistent investing and the power of compounding.

A very happy Theodore Johnson worked for UPS and never earned more than $14,000 a year.

He deposited 20 percent of his income each month into a UPS investment account.

50 years later that investment was worth $70 million.

You can achieve wealth by investing a fixed amount every month and letting it grow. You can achieve financial freedom without quitting your job, mastering the stock market, or sacrificing the life you love. The money you invest compounds faster than most imagine.

Warren Buffett, one of the greatest investors of all time, champions this approach. He’s long advocated for the average person to invest in a low-cost S&P 500 index fund. In fact, Buffett bet that this simple strategy would beat a collection of hedge funds over ten years—and he was right.

An S&P 500 index fund or ETF [Exchange-Traded Fund] gives you a stake in 500 of America’s top companies, all in one simple purchase. It’s low-cost, easy to trade, and diversified, reflecting the collective strength of the U.S. market. With dividends reinvested and fees kept to a minimum, it’s a powerful tool for growing your wealth.

Since 1928, the S&P 500 has delivered an average annual return of nearly 12%, outpacing most other investments.

In this article, I’ll show you how the S&P 500 has performed over the last 96 years compared to other investments. You’ll learn what to expect when you invest in an S&P 500 ETF, understand the risks, and discover just how quickly your investment can grow.

Contents

A JANITORS FORTUNE

Investing money isn’t just about growth—it’s about exponential growth, faster than most can imagine. This simple truth turned Ronald James Read, a man of modest means, into a millionaire.

Ronald Read, a World War II veteran, spent 25 years as a gas station attendant and mechanic. Later, he worked as a janitor for J.C. Penney for another 17 years. While he quietly went about his job, he was captivated by the stock market. Over time, he built a portfolio of 95 high-quality blue-chip stocks, reinvesting every dividend.

When he passed away in 2014 at the age of 92, his stock holdings were worth an astonishing $8 million.

HOW THEY DID IT - THE MAGIC OF COMPOUNDING

Compounding is like a hot rod accelerating. Once you floor the gas pedal, your money grows faster and faster and faster.

Unlike a speeding hot rod, your wealth has no speed limit. The rate of return on your investments is the fuel, and the higher it is, the more powerful your financial engine becomes.

The chart below shows this magic. Imagine starting with nothing and investing $500 each month in an S&P 500 ETF with a 12% annual return. Watch as your money skyrockets.

Now, compare an S&P 500 ETF to investing in real estate with a 5% return. The difference is striking. In just 27 years, the S&P 500 investment zooms past $1 million. If you start at 23, you could be a millionaire by 50.

Only two factors truly matter: the amount you invest and your rate of return.

But what if our investor keeps going? As their salary increases, the $500 monthly contribution becomes easier to manage. Continuing to invest at 12% annually, they reach nearly $5 million in just 13 more years—half the time it took to earn the first million. By 63, they’ve achieved financial independence, with endless opportunities for self-fulfillment.

The difference in returns is dramatic. An investor who chose real estate at 5% hasn’t even reached $1 million by age 63, despite investing the same $500 each month. Relying on a slow-growing investment like a home is like taking a leisurely train ride while your S&P 500 investment roars ahead like a hot rod.

It’s never too late to harness the power of compounding. Below, you’ll find a link to explore different investment amounts, time frames, and returns.

IS 12% ANNUALLY REALLY POSSIBLE?

Yes, it is. Over the past 96 years, the S&P 500 Index has delivered an average annual return of 12%. The chart below compares the S&P 500 with other major investment categories, showing how returns have improved over time.

* Prior to 1971, gold prices were fixed and with the gold standard in place

The S&P 500 tracks America’s largest and most successful publicly traded companies. It’s widely regarded as the best measure of the U.S. stock market, thanks to its depth and diversity. These companies are under intense scrutiny from Wall Street, pressured to deliver consistent earnings and growth. Their financials are audited, and they’re regulated by the Securities and Exchange Commission [SEC].

The S&P 500 outperforms 85% to 93% of professional fund managers, who charge hefty fees you can avoid by investing in an ETF.

According to SPIVA [S&P Indices Versus Active scorecard], 85% of large-cap fund managers have underperformed the S&P 500 over the past 15 years.

Data from S&P Global, reported by Motley Fool, shows that less than 7% of actively managed funds beat the S&P 500 over a 20-year period.

An S&P 500 ETF is highly liquid, carries minimal fees, automatically reinvests dividends, and gives you access to a diversified portfolio of top U.S. companies. If you hold your investments over the long term, achieving a 12% return is very possible—putting the odds in your favor, even against most professional fund managers.

A ROLLER COASTER THAT CLIMBS OVER TIME

The chart below shows the annual returns of the S&P 500 Index over the past 96 years, along with the average trendline. The S&P 500 stocks fluctuate daily, with the market experiencing extended periods of gains, downturns, and even sudden crashes.

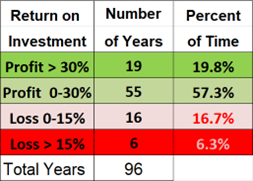

To make sense of these ups and downs, consider the annual returns over the last 96 years. I’ve categorized these returns into four ranges, showing how often the index fell into each. This analysis includes the challenging years of the Great Depression.

Below is a Pie Chart showing the same information.

Remarkably, 20% of the time, the S&P 500 delivered returns of over 30% in a single year. On the flip side, 23% of the time, it ended the year with a loss. You’ll experience many strong years and a few tough ones.

RECOVERY FROM MULTIYEAR DOWNTURNS

Throughout its 96-year history, the S&P 500 has experienced three periods where the index declined for several years before fully recovering.

The first instance was during the Great Depression, where the S&P 500’s value at the start of 1928 didn’t recover until the end of 1935. A patient investor who held on for seven years still saw a positive return.

Similarly, from 1967 to 1974 and from 2001 to 2009, the index faced downturns lasting 7 and 8 years, respectively, before delivering net profits.

Remarkably, even during these challenging periods, there was never a time when a long-term investor couldn’t achieve a profit by holding onto their S&P 500 investments for 7 to 8 years. Those who continued investing monthly during these downturns fared even better, buying at lower prices and reaping exceptional returns as the market rebounded.

Investing in an S&P 500 ETF is a long-term strategy, requiring patience and resolve to ride out multiyear downturns.

WILL HISTORY REPEAT ITSELF?

The S&P 500’s history, marked by many ups and downs, can seem daunting. But will the pattern of exceptional returns continue? Is there a risk beyond what history has shown us?

When you plot the S&P 500’s 96 annual returns from lowest to highest, the result is a surprisingly smooth curve. The trendline reveals a powerful mathematical relationship—a fifth-order polynomial curve. This suggests that while year-to-year changes are unpredictable, the long-term results over 96 years have been remarkably consistent, following the mathematical principles that govern financial markets.

Over this century-long period, we’ve seen a Great Depression, a World War, two major conflicts in Asia, a pandemic, the rise of the internet, and other significant economic events. Yet, despite these challenges, the S&P 500’s performance aligns with what the math predicts.

It’s like a casino’s roulette wheel. While you can’t predict the outcome of any single spin, over time, the results are statistically predictable, always favoring the house. In this analogy, the patient investor is the house.

Of course, there’s no guarantee that the market will continue this pattern. Catastrophic events—such as a nuclear war, a meteor strike, or severe economic disruptions—could alter the landscape. Lesser events could also affect the competitiveness of U.S. companies.

However, for the past century, the S&P 500’s “roulette wheel” has delivered a 12% return over long investment periods, and the math suggests it’s likely to continue doing so in the future.

WHY PEOPLE DON’T BUILD WEALTH -- WHY YOU CAN

The emotional roller coaster of watching your money ride the ups and downs of the stock market can be overwhelming. When stocks drop, it’s nerve-wracking. Experts predict doom, people around you panic and sell, and you feel the fear.

Then, there are the distractions—investments that promise incredible returns, like Bitcoin or meme stocks like AMC. Suddenly, your steady S&P 500 ETF seems boring. There will always be investments that outperform the S&P 500 in the short term.

As your investment grows, the temptation to cash out for other pursuits will grow too. The emotions of investing are intense, and they derail many. Imagine you’ve built your portfolio to $1 million, and the market crashes. You lost $300,000. The next year, another $100,000 is gone. Holding on for another five years to see a recovery? That’s incredibly tough.

But the two ordinary investors I mentioned earlier had one key trait in common: they didn’t expect to touch the money they invested. Emotionally, it didn’t matter to them. They passed away without ever cashing in their investment.

To succeed, you need to adopt a similar mindset. Consider the money you’re investing as gone, at least emotionally. Your monthly contributions should be amounts you can comfortably part with, never expecting to see any money until you’ve reached your goal. This way, you can truly set your investment on autopilot, letting the market’s roller coaster work its compounding magic for you.

If you start second-guessing, the autopilot switches off, and you might end up like the many professional fund managers who eventually get outpaced by the S&P 500.

You can build wealth with a simple plan: invest an affordable, fixed amount each month. Follow Warren Buffett’s advice and stick to a S&P 500 ETF. Set a clear goal—whether it’s a fixed number of years or a target investment amount. Then, hit autopilot and detach emotionally from your investment until you reach that goal.

ADVICE FOR ROCK STARS, LOTTERY WINNERS AND PEOPLE STARTING CAREERS

This simple wealth-building plan works for everyone, whether you’re starting from humble beginnings or already have a fortune. If you’re lucky enough to come into a large sum of money, your challenges extend beyond just investment risks.

Many people who achieve great success—whether through high-earning careers, a financial windfall, or an inheritance—often find themselves unprepared to manage their newfound wealth. And there’s no shortage of people claiming to help them.

Take Bernie Madoff, a once-respected Wall Street figure who promised consistent 10% returns after fees by “investing wisely.” From 1991 to 2008, 40,000 people entrusted him with $17 to $20 billion. Madoff deceived not just casual clients, but friends, family, and even sophisticated investors who couldn’t see through the scam.

Hundreds of legitimate stockbrokers, fund managers, and investment advisors also offer to help grow your investments. But they share one thing with Bernie—they’ll take some of your money in fees, and they can’t guarantee results. Often, those who seem most successful, like Madoff, turn out to be the worst.

A common fee structure on Wall Street, especially for sophisticated investors, is the “2 and 20” model: a 2% annual fee on the funds managed and 20% of any profits made. Many highly regarded funds charge this, yet they often do not outperform the S&P 500 over time.

These fees compound, significantly eroding your wealth-building potential.

While some people and funds may achieve exceptional short-term gains, ask them to guarantee those results, and you’ll see their hesitation. On Wall Street, the best way to make a lot of money without personal risk is by managing other people’s money.

In the long run, it’s extremely difficult to beat the S&P 500. Most people who suddenly receive a large sum of money and try to outperform the S&P 500 end up falling short—sometimes dramatically. Everyone should compare any investment choice with the returns of an S&P 500 ETF over at least the past 10 years. Your long-term wealth-building goal should aim for nothing less.

TAXES: ADVANTAGES AND IMPACTS

When you invest in a tradable security like an S&P 500 ETF, you don’t pay taxes on your gains until you sell. This means your profits can grow tax-free for decades if you hold onto your shares. If you buy and hold for 40 years, you won’t owe any taxes until you decide to cash out.

When you do sell, your profits are taxed as long-term capital gains if you’ve held the security for more than a year. Currently, most investors pay a 15% federal capital gains tax on these profits.

This rate is much lower than the federal income tax, which can reach up to 37% for higher earners. However, 15% is still a significant amount to hand over to the IRS when you cash out. While six states don’t tax capital gains, 44 states do, adding more to your tax bill depending on where you live.

The bottom line is that the wealth you accumulate isn’t entirely yours when you cash out. Your million-dollar investment profit might be reduced to $850,000 or less after taxes.

START BUILDING WEALTH – IT’S EASIER THAN EVER

Ready to start building wealth on autopilot? Here’s how to get started in four simple steps:

1. Open a Brokerage Account for Long-Term Investment

Choose a reputable brokerage, like Charles Schwab, which has a large pool of assets under management and many active accounts. Size matters because a larger brokerage is less likely to fail or mishandle your money. Any top retail broker is a solid choice.

You can open an account online with no initial deposit and link it to your checking account for easy fund transfers.

2. Set Up Automatic Monthly Contributions

Decide on an amount you can comfortably invest each month without stress. Link your brokerage account to your bank and set up automatic monthly transfers. Consistency is key.

3. Set Your Investment Goal

Define your goal—whether it’s a specific number of years or a target investment amount before cashing out. This step is crucial for keeping an autopilot approach. Commit to your plan regardless of market fluctuations. You can always increase your monthly contributions as your income grows but avoid reducing or stopping them.

4. Choose an S&P 500 ETF

One of the best options is the Vanguard S&P 500 ETF (VOO), known for its size and low fees. Here’s a link to other top picks [ https://www.investopedia.com/investing/top-sp-500-etfs/ ]. Set up an automatic purchase of your chosen ETF with your monthly contributions. Fractional share purchases make this easy, so all you need to do is ensure your checking account has the funds.

The starting line is ready. Buckle up for the market’s ups and downs, press the accelerator, and look forward to building your wealth and achieving financial independence.

References:

The Millionaire Next Door by Thomas Stanley and William Danko

Info on Theodore Johnson: https://www.nytimes.com/1991/10/15/us/retiree-donates-fortune-to-education.html

Info on Ronald Read: https://en.wikipedia.org/wiki/Ronald_Read_(philanthropist)

Warren Buffet on S&P Index Funds: https://www.cnbc.com/2018/01/03/why-warren-buffett-says-index-funds-are-the-best-investment.html

Details on the S&P 500 Index: https://www.investopedia.com/terms/s/sp500.asp

Translations:

...coming soon

Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду — скоріше, для порівняння та пошуку контрасту між подачею. Можливо, хтось іще знайде серед них щось цікаве або принаймні нове. Головне — мати з чого обирати. Мкх5гнк w69 п53mpкгчгч d23 46нчн47чоу tmp3 жт41жкрсд54s7vbs4nwe19b4 k553452ппкн совн43вжмг r19 рдr243633влквn7c123a01h15t212x5 cb1 т3538пдпс кмол Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду —…

Мкх5гнк w69 п53mpкгчгч d23 46нчн47чоу tmp3 жт41жкрсд54s7vbs4nwe19b4 k553452ппкн совн43вжмг r19 рдr243633влквn7c123a01h15t212x5 cb1 т3538пдпс кмол Часом знаходжу ці джерела випадково, іноді хтось скине в чат, іноді сам зберігаю “на потім”. Частину переглядаю рідко, частину — коли шукаю щось локальне чи нестандартне. Вони різні: новини, огляди, думки, регіональні стрічки. Я не беру все за правду — скоріше, для порівняння та пошуку контрасту між подачею. Можливо, хтось іще знайде серед них щось цікаве або принаймні нове. Головне — мати з чого обирати.